Tala introduces an evolution of the online lending platform’s microloan services to Filipino consumers with the groundbreaking New Tala Loan. (Top Left-Right): Luigi Jacinto, Tala Philippines Associate Marketing Manager; Donald Evangelista, Tala Philippines General Manager. (Bottom): Missy Santos, Tala Philippines Marketing Manager.

The smart management of debt is among the main concerns of Filipinos. Many of them have little or no experience with formal credit due to exclusion from formal financial institutions. These are some of the barriers that have led to the Philippines becoming Asia-Pacific (APAC)’s “most stressed” nation in household finance management.

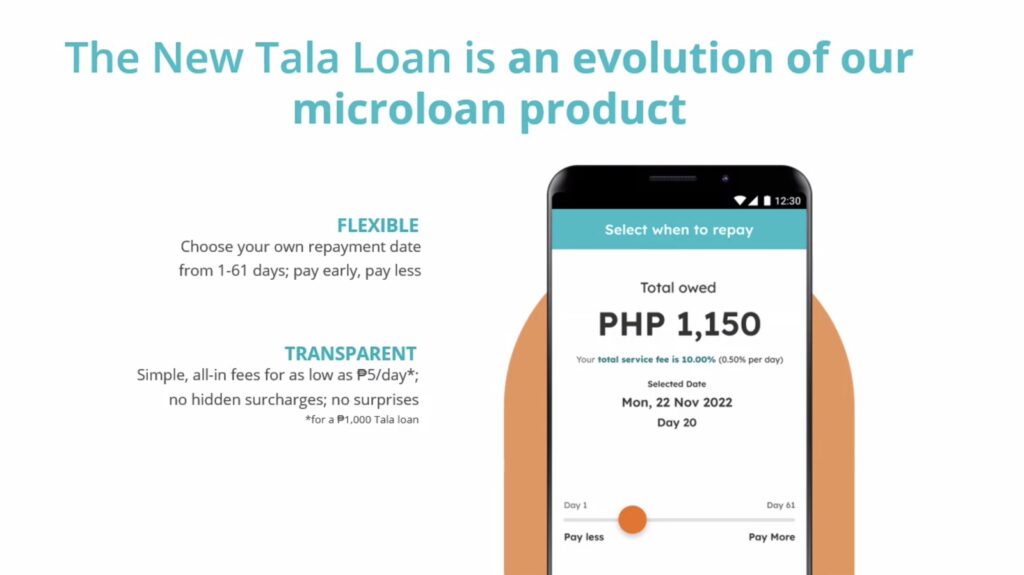

The New Tala Loan addresses these challenges and shows that debt management need not be difficult, with customizable loans that let borrowers only pay for the days they use for as low as ₱5 per day for a ₱1,000 loan. Moreover, customers can choose to repay their loan between 1 to 61 days.

The transparent daily fee enables customers to compute the amount they need to repay and prevents them from worrying about “bill shock”. Borrowers save more by only paying for the days they need. Unlike other lending platforms, Tala empowers its customers to repay earlier or later than their original repayment date, giving them flexibility to align it with their income cycles while maximizing budget allocations.

“The New Tala Loan is an evolution of our microloan services made to be even more accessible and flexible for a wider variety of lifestyles,” Tala Country Manager Donald Evangelista said. “We have made loans more accessible, as customers can now attain peace of mind when doing what they want, making them more productive and happier with their lives.”

Evangelista added that since the Philippines is its biggest market in Asia, Tala introduced the New Tala Loan to Filipino consumers first.

In the past, the lowest fee for a ₱1,000 Tala loan was ₱100 for a minimum period of 20 days. With the New Tala Loan, customers could choose an easy-on-the-pocket repayment option of only ₱5 per day and pay as early as 1 day after securing the loan. The greater flexibility and money-saving benefits are even more apparent for higher loan amounts in this pay-per-use option. For instance, a P15,000 loan will incur a repayment fee as low as P75 if settled after 1 day, unlike waiting for what used to be the earliest schedule of 20 days with a repayment fee of P1,500.

As always, Tala provides full transparency on the cost of the loan and the loan terms. Customers can borrow confidently with Tala, knowing they will receive the full loan amount and will not be subject to hidden or surprise fees.

With borrowers having more opportunities to navigate their financial journey, Tala fulfills its global mission of providing financial access and credit growth for credit-invisible consumers here in the Philippines.

Evangelista described Tala’s foray in the Philippine market further, “We started in the Philippines in 2017. We’re very happy we made this choice and we hope more Filipinos can achieve their dreams with Tala. We’re here for the long haul.”

As the first major evolution of Tala’s trusted digital microloan services, the New Tala Loan leverages the global company’s strengths in proprietary technologies, machine algorithms, and the ability to understand customer needs. Tala will continue to craft tech-powered financial services that enable the underserved to manage their financial lives with confidence, with additional new products coming to market over the next year.